In the world of banking and finance, loan lending mobile app development is an important step toward improving the loan process. Organizations can speed up the loan process and provide a seamless borrowing experience by embracing technology and prioritizing user convenience.

This article discusses the main elements of peer-to-peer loan lending app development and a step-by-step process on how to build a loan app that raises the bar for the banking industry.

Building a loan app requires a deep knowledge of development in the right way. While we are covering a short note, you divert your attention to this link and read how Topflight is doing it.

Link: https://topflightapps.com/ideas/how-to-create-a-loan-app/

Why Are Loan Apps So Popular?

As of 2022, 27% of all bank customers in the United States were using online services. People are increasingly turning to online banking due to its convenient advantages, such as 24/7 availability and lower prices. Meanwhile, businesses move swiftly to fill numerous digital banking sectors ranging from cash advance applications to loan lending apps.

Let’s get into why people would rather utilize money borrowing apps than deal with the trouble of going to a bank for a loan:

Convenience and Accessibility

You don’t have to sit around for hours at the banks while you wait for the approval to process. Instead, loan applications, document submissions, and funding can all be made entirely in the palm of your hand.

Streamlined Application Process

These apps simplify the application procedure and shorten the time required to complete it.

Faster Approvals

Users wait less time for the evaluation of their creditworthiness and money disbursements because of the apps’ usage of smart algorithms and data analytics.

Tailor-Made Offerings

By analyzing a person’s financial data and behaviors, data analytics also enables tailor-made loan choices.

Latest Trends in Loan Apps

The six most popular digital banks in Europe that solely offer apps had more than 80 million downloads combined as of January 2023. Digital lending is gaining major traction with the rise of app-only digital banks in Europe. In order to build a loan application, you should first consider understanding the market trends of loan apps:

Improved Customer Support

The fintech industry is increasingly focusing on providing an exceptional client experience. Self-service and other forms of individualized customer care are no longer a luxury but a requirement.

Chatbots and Virtual Assistance

Integrating AI-driven chatbots and virtual assistants allows businesses to assist customers 24/7. These tools improve user experiences, streamline processes, and boost customer satisfaction by making customized loan suggestions.

API Banking

Using an open application programming interface (API) in banking enables secure data sharing between services and financial institutions. As a result of open application programming interfaces (APIs), fintech firms now have access to traditional banking systems and can provide alternative lending options to a much wider customer base.

Working on Loan Apps – The Flowline

Loan lending mobile apps simplify the procedure by incorporating a variety of important functions. In order to make a money-lending app, use the following flowline:

Customer Verification

First, the user will make a profile by entering their name, email address, and other relevant information. The app verifies their identity and analyzes their credit report to decide if a user is eligible for a loan.

Loan Application Process

Users who have registered are then eligible to apply for loans. They select an amount to borrow, choose their payback schedule, and supply the necessary paperwork. The application is analyzed by the lender, who determines the borrower’s eligibility and creditworthiness based on the data provided.

loan Approval

Once the transaction is approved, the app will arrange a safe transfer of funds to the customer’s chosen account. The data about payments and their dates allows users to plan their repayment schedules easily. Users can make payments quickly and conveniently through built-in payment methods, and on-time payments are also encouraged through automatic reminders and notifications.

Repayment

The app can handle any fees or penalties that come as a result of late or missed payments. Mobile apps that facilitate lending streamline the loan process from application to approval to payment to repayment.

Salient Features of Loan Apps

Regardless of the primary goal of a loan lending app, some functionalities are expected by users. By including them, you can improve the user experience and give borrowers access to important features. Whether you’re a bank or a fintech company, if you add these features, your lending app will be more user-friendly and more appealing to its intended demographic.

Tracking and Reminders

The app should give you an easy-to-understand snapshot of your loan balance, payment history, and due dates. Borrowers can make sure they pay back their loans on time and avoid late fees by signing up for push notifications and reminders.

Friendly UI

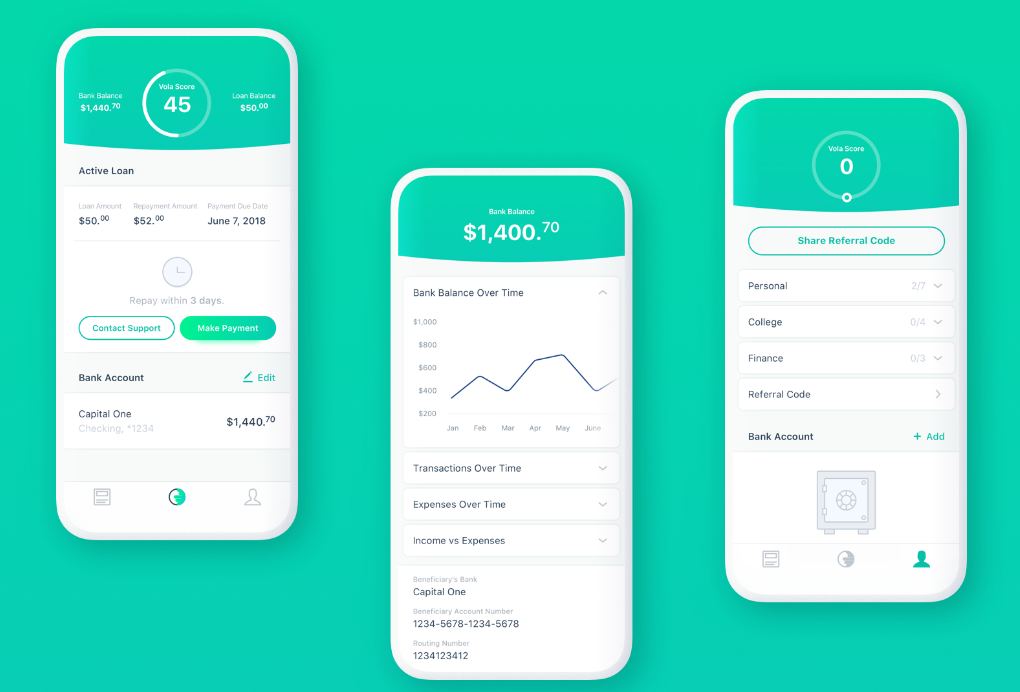

Users can quickly and easily access the app’s features and data thanks to its clean and straightforward design. The user experience improves with the addition of clear and simple menus, well-organized screens, and the logical arrangement of key tasks.

Loan Calculator

Based on the loan amount and user-specified terms, this calculator provides an estimate of the user’s monthly payment, interest rate, and total repayment amount.

Secure Payment Method

In order to protect customers’ personal information during loan repayments, the developers implement encrypted payment gateways. Standards like SSL, SFTP, and AES (Advanced Encryption Standard) are commonly used for security. To further ensure the safety of your customer’s private data, you can also team up with reputable payment processors like Stripe payment.

Document Verification

The time it takes to evaluate and authorize an application can be reduced if borrowers are given the option to submit supporting papers online. In addition, you can improve the app’s performance while still meeting all relevant regulations by incorporating verification services like digital identity verification or credit score evaluation.

Risk Assessment

Every app that offers loans should conduct a thorough risk assessment, looking at things like user profiles, credit reports, and other potential dangers. Machine learning assists in the creation of acute risk profiles, resulting in more reliable loan acceptance choices.

Big Data Analytics

Using big data analytics tools, you can examine information about your app’s users and learn how to make it better. For example, you’ll eventually have enough data to segment your consumer base and adapt products and offerings accordingly. In addition, you’ll be able to tailor advertising campaigns and finance options to certain demographics.

AI Chatbots

As of the year 2022, 88% of users reported having at least one discussion with a chatbot. Chatbots are used by customers to get immediate responses to questions or issues. A chatbot included within the app can offer users immediate assistance and answer questions on a wide variety of topics.

Right Steps of How to Build a Loan App

Research and Discovery

The process of creating a lending app starts with thorough research and discovery. This requires familiarity with the market, its customers, and the other businesses in it. To effectively develop the app’s features and functionalities, it is crucial to acquire insights and analyze user preferences, market trends, and legal needs.

Development

The development stage starts when the research phase is over. This involves creating a solid backend infrastructure, designing the app’s user interface and user experience, and coding in features, including loan application forms, borrower verification procedures, and connectivity with payment gateways. The development approach should prioritize scalability, security, and performance to guarantee a dependable and effective lending app.

Testing and Troubleshooting

Following the app’s development, extensive testing is required to discover and resolve any flaws or defects. These tests guarantee the app’s features are working as expected, the app’s responsiveness and stability under different conditions, and the app’s security so that users’ information is safe. Borrowers benefit from testing and troubleshooting since it ensures a smooth and error-free experience.

Deployment

After the loan app has been thoroughly tested and any remaining issues have been fixed, it can be released to the public. This necessitates publishing the app to the appropriate app stores or platforms. During the deployment process, it is critical to ensure seamless interaction with backend systems and third-party services, as well as compliance with any applicable legislation or guidelines.

Preparing Technical Documentation

Maintaining detailed technical documentation is a must throughout developing a loan app. The technical specifics of the app, such as its architecture, APIs, database structures, and security measures, must be documented. Well-prepared technical documentation provides improved communication within the development team, facilitates future additions or updates, and aids in the smooth onboarding of new team members or stakeholders.

We hope this article will help you understand the process of how to build a loan app.